Managing money, sticking to a budget and even handling investment decisions are easier than even before with today's crop of personal finance apps.

But not every tool out there is actually worth downloading and learning to use. You can take some of the guesswork out of moving your finances to mobile with this list of the best personal finance apps for 2018.

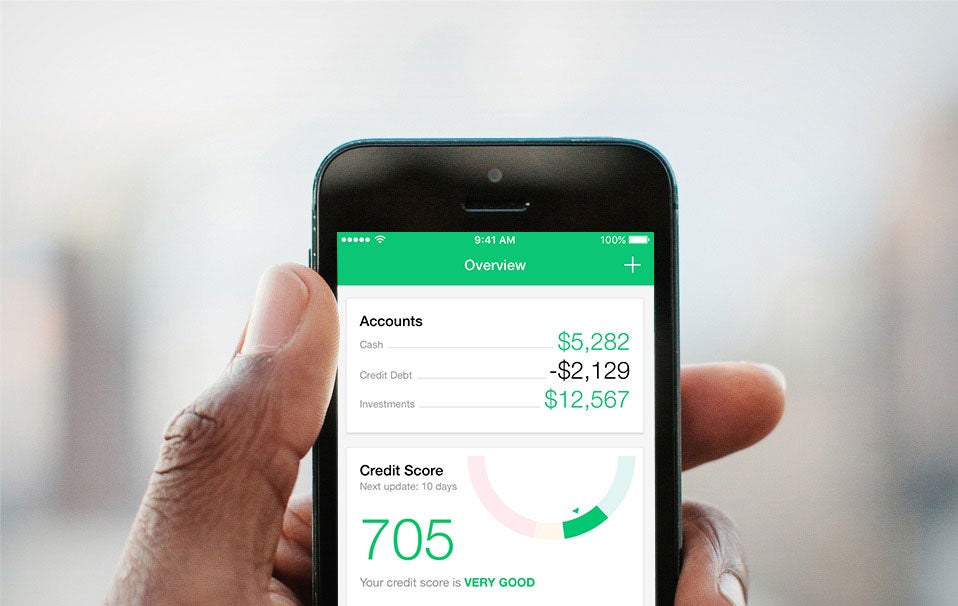

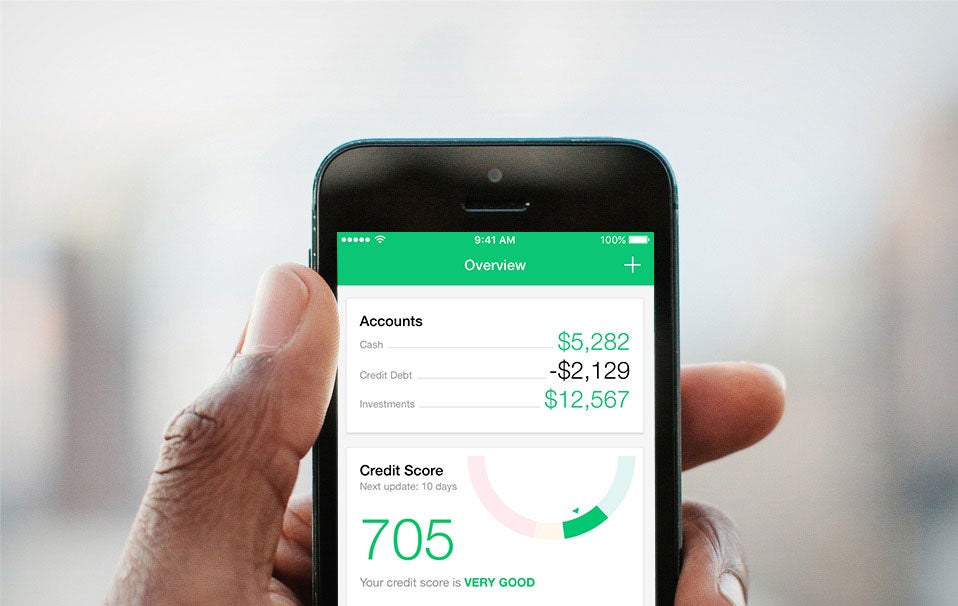

1. Mint: Best app for managing your money.

Hands down, the free Mint app from Intuit Inc. (INTU) – the name behind QuickBooks and TurboTax – is an effective all-in-one resource for creating a budget, tracking your spending and getting smart about your money. You can connect all your bank and credit card accounts, as well as all your monthly bills, so all your finances are in one convenient place – no more logging in to multiple sites.

Mint lets you know when bills are due, what you owe and what you can pay. The app can also send you payment reminders so you can avoid late fees. Based on your spending habits, Mint even gives you specific advice to gain more control over your budget. The free credit score is a nice bonus, too.

Special features: Shows your real-time credit score

This app is for you if: You want to know how much money you have at any given time across multiple accounts and cards.

2. You Need a Budget: Best app for getting out of debt

You Need a Budget (YNAB to enthusiasts) is unlike any other budgeting app you've used before. YNAB helps you stop living paycheck to paycheck, pay down debt and "roll with the punches" if something unexpected comes up. It's built around a fairly simple principle – every dollar has a job.

You Need a Budget doesn't let you create budgets around money you don't have – it forces you to live within your actual income. If you get off track (and who doesn't occasionally?), YNAB helps you see what you need to do differently to balance your budget. The built-in "accountability partner" keeps you on your toes. Although users pay a small monthly or annual fee for YNAB, the service and support are worth it. Online classes with a live instructor for Q&A to help you learn budgeting basics are included. In fact, YNAB is so effective that the average user pays off $500 in debt the first month.

Special features: Not only can you set up weekly/monthly budgets (all personal finance apps do that!) but you can also set up budgets or individual projects, like "Christmas gifts 2018."

This app is for you if: Every other attempt you've made to get your budget in check has left you frustrated and hopeless.

3. Wally: Best app for tracking expenses

If you're the sort of person who'd love to be as organized with personal expense tracking as you are with your expense reports at work, you'll love the totally free Wally app. Instead of manually logging your expenses at the end of the day (or week or month), Wally lets you simply take a photo of your receipts. And if you use geo-location on your device, it even fills in that info, saving you several steps.

Wally is a clean, streamlined app that's extremely convenient and easy to use. It's a great choice if you'd like more insight into where your money is going.

Special features: You can take a photo of your receipts instead of manually entering numbers. Less typing=less fat-fingering errors.

This app is for you if: Your previous attempts to track expenses were abandoned within a month because you hated typing stuff.

4. Acorns: Best app for painless saving

Want to harness the benefits of automating good financial behavior? If that sounds complicated, the Acorns app decidedly isn't. Basically, every time you make a purchase with a card connected to the app, Acorns rounds it up to the next highest dollar and automatically invests the difference in a portfolio of low-cost exchange-traded funds (ETFs) that you select based on your risk preference.

Acorns puts your pocket change to work in an utterly painless way – users say that they never even notice the difference. Wouldn't you love to find an extra $300 or $500 or even $1,500 in your investment account each year? The service is free to college students and charges just $1 per month for pretty much everyone else.

Special features: You can set up your Acorn app to automatically invest your savings without your even knowing about it

This app is for you if: You have never owned a share of stock because you thought you didn't have enough money to invest.

But not every tool out there is actually worth downloading and learning to use. You can take some of the guesswork out of moving your finances to mobile with this list of the best personal finance apps for 2018.

1. Mint: Best app for managing your money.

Hands down, the free Mint app from Intuit Inc. (INTU) – the name behind QuickBooks and TurboTax – is an effective all-in-one resource for creating a budget, tracking your spending and getting smart about your money. You can connect all your bank and credit card accounts, as well as all your monthly bills, so all your finances are in one convenient place – no more logging in to multiple sites.

Mint lets you know when bills are due, what you owe and what you can pay. The app can also send you payment reminders so you can avoid late fees. Based on your spending habits, Mint even gives you specific advice to gain more control over your budget. The free credit score is a nice bonus, too.

Special features: Shows your real-time credit score

This app is for you if: You want to know how much money you have at any given time across multiple accounts and cards.

2. You Need a Budget: Best app for getting out of debt

You Need a Budget (YNAB to enthusiasts) is unlike any other budgeting app you've used before. YNAB helps you stop living paycheck to paycheck, pay down debt and "roll with the punches" if something unexpected comes up. It's built around a fairly simple principle – every dollar has a job.

You Need a Budget doesn't let you create budgets around money you don't have – it forces you to live within your actual income. If you get off track (and who doesn't occasionally?), YNAB helps you see what you need to do differently to balance your budget. The built-in "accountability partner" keeps you on your toes. Although users pay a small monthly or annual fee for YNAB, the service and support are worth it. Online classes with a live instructor for Q&A to help you learn budgeting basics are included. In fact, YNAB is so effective that the average user pays off $500 in debt the first month.

Special features: Not only can you set up weekly/monthly budgets (all personal finance apps do that!) but you can also set up budgets or individual projects, like "Christmas gifts 2018."

This app is for you if: Every other attempt you've made to get your budget in check has left you frustrated and hopeless.

3. Wally: Best app for tracking expenses

If you're the sort of person who'd love to be as organized with personal expense tracking as you are with your expense reports at work, you'll love the totally free Wally app. Instead of manually logging your expenses at the end of the day (or week or month), Wally lets you simply take a photo of your receipts. And if you use geo-location on your device, it even fills in that info, saving you several steps.

Wally is a clean, streamlined app that's extremely convenient and easy to use. It's a great choice if you'd like more insight into where your money is going.

Special features: You can take a photo of your receipts instead of manually entering numbers. Less typing=less fat-fingering errors.

This app is for you if: Your previous attempts to track expenses were abandoned within a month because you hated typing stuff.

4. Acorns: Best app for painless saving

Want to harness the benefits of automating good financial behavior? If that sounds complicated, the Acorns app decidedly isn't. Basically, every time you make a purchase with a card connected to the app, Acorns rounds it up to the next highest dollar and automatically invests the difference in a portfolio of low-cost exchange-traded funds (ETFs) that you select based on your risk preference.

Acorns puts your pocket change to work in an utterly painless way – users say that they never even notice the difference. Wouldn't you love to find an extra $300 or $500 or even $1,500 in your investment account each year? The service is free to college students and charges just $1 per month for pretty much everyone else.

Special features: You can set up your Acorn app to automatically invest your savings without your even knowing about it

This app is for you if: You have never owned a share of stock because you thought you didn't have enough money to invest.

Comments

Post a Comment

Jarring comments...